Subscription

USTY tokens are offered based on a Private Placement Memorandum (PPM) that outlines the investment opportunity, risks involved, financial information, and other relevant details.

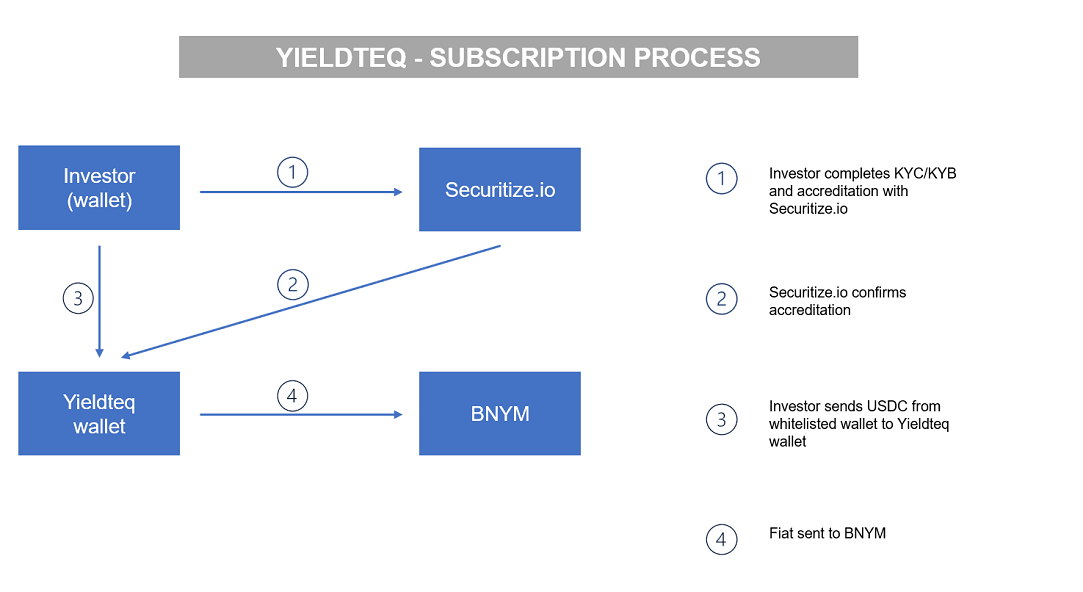

Once an investor has been accredited, they are considered whitelisted and will move into the subscription process. To subscribe, the investor deposits USDC to the designated wallet of Yieldteq. In exchange, the investor will receive USTY tokens that are of an equivalent US$ value at the time of conversion from USDC to US$, net of transaction fees, costs, and expenses. The exact number of USTY tokens that the investor will receive is a function of the amount of USDC deposited, the prevailing US$/USDC exchange rate at the time of deposit, and the NAV of the ETF.

The Minimum Initial Subscription Amount is US $20,000. The Minimum Subsequent Subscription Amount is US $10,000. The issuance of USTY tokens is subject to a minimum offering of US $2,000,000.00 being achieved.

To subscribe, prospective purchasers must visit the website yieldteq.io to register on that site and submit information and documents necessary for the Company to: (i) confirm that that the prospective purchaser meets all applicable investor suitability criteria, including those imposed by that prospective purchaser's country of domicile; (ii) complete "Know Your Client" verification, and (iii) conduct Anti-Money Laundering due diligence and screening. Prospective purchasers will also be required to execute and deliver the Subscription Agreement and accompanying questionnaire available through the site.

The subscription procedures will involve, without limitation the following steps:

Investor registers for the offering on the website www.yieldteq.io;

Investor reviews the information provided in the PPM;

Investor reviews and completes the subscription agreement, including Know Your Customer, Anti-Money Laundering, suitability, and accreditation verification;

Investor completes and signs the subscription agreement and related forms;

Company reviews the purchaser submission for investor suitability standards, Know Your Client and Anti-Money Laundering screening;

Company confirms acceptance of the subscription subject to the minimum offering being achieved;

Investor funds the subscription wallet;

Company confirms allocation to Investor.

Prospective investor and the Company will review and electronically sign validated subscription documents and a final executed subscription agreement will be available to the Investor.

The Company will only accept payment for the Tokens in USDC in an amount equivalent to the US$ amounts set forth above.

The following diagram provides a high-level overview of the subscription process.