Accreditation

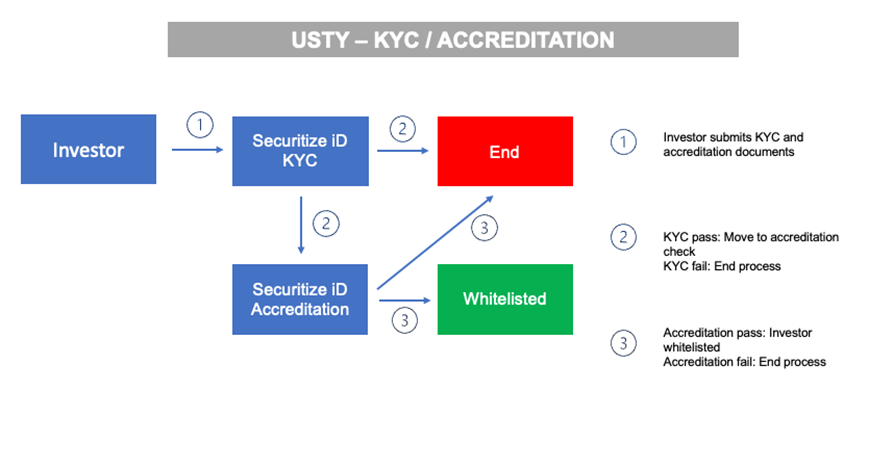

USTY tokens are offered in compliance with Rule 506(c) of the U.S. Securities Act of 1933. This means that USTY is open to accredited investors. Prior to accepting subscriptions for USTY, Yieldteq must verify that each investor meets these accredited investor criteria. The verification is conducted by Yieldteq’s partner Securitize iD. It may include reviewing financial statements, tax returns, bank statements, or obtaining written confirmation from a qualified third party, such as a registered broker-dealer, attorney, or certified public accountant.

To qualify as an accredited investor under Rule 506(c), an individual must meet one of the following criteria:

Income Test: The individual must have an annual income of at least $200,000 for the past two years (or $300,000 combined income with a spouse) with a reasonable expectation of reaching the same income level in the current year.

Net Worth Test: The individual must have a net worth of at least $1 million, excluding the value of their primary residence. Alternatively, if the individual is married, their combined net worth with their spouse must exceed $1 million.